How We Invest

Generating high risk-adjusted returns through Venture Fund and Direct Investing

About UGVP

Union Grove Venture Partners is a leading VC Fund of Funds firm, ranked #1 by HEC Paris in both 2022 and 2023. Founded in 2012, UGVP fosters enduring trust by nurturing innovation and investing in differentiated real entities. The firm leverages the deep expertise of its team, with experience across economic cycles, industries, and technology sectors.

UGVP leverages a two-pronged strategy: 1) investing in established and emerging US funds across stages & 2) amplifying returns with strategic co-investments alongside their fund managers. The firm tends to target high-growth tech and healthcare companies. Their focus on building strong relationships with leading General Partners grants them exclusive access to high-conviction opportunities.

Hybrid Investment Model

30%

Concentrating capital in best ideas

Primarily co-investments with underlying managers

Expansion and later-stage focus (revenue-generating)

Target 3x -5x return with >5x upside potential

70-80%

~75% target to core, established funds

~25% target to emerging funds

Meaningful exposure, deep relationships

Due Diligence Criteria

-

Succession

Current team

Fund size and pacing

Brand relevancy

Performance stickiness

Portfolio construction

Value-add

Good Human Rule

-

Portfolio Construction

Fund management experience

Sourcing advantage

Cap table access

Value-add platforms

Reputation with founders

Network(s)

Early indicators

Franchise potential

Sector Expertise

Good Human Rule

-

Typically co-investment with fund

Value-add through transparency & efficiency

Moat

Market demand

Competitive landscape

Management checks

Portfolio Case Studies

Beyond Meat

-

Direct Co-Investment with Kleiner Perkins in 2013

-

Beyond Meat is a company that sells plant-based meat substitutes that mimic the taste, texture, and appearance of animal-based meat. Meat's goal is to provide sustainable and environmentally friendly protein options without sacrificing taste or nutrition.

-

How did we get involved?

Through our strategic relationships at Keilner Perkins

How did we know Beyond Meat was a winner?

Beyond Meat was solving a significant problem with a unique agriculture technology. While current animal-based proteins such as chicken and cow meat only convert 9-14% of protein into muscle mass, Beyond Meat could convert 94%. This means the same portion of meat could feed 10x as many people, making it an incredibly efficient alternative. The way they accomplished this was transparent - by stapling the ends of the proteins together to create meat-like texture & using high heat & water pressure. Our due diligence of the company confirmed our initial high conviction of the product, company, and market demand. After we invested, Greg served on the board for six years.

-

Beyond Meat held it’s initial public offering on May 2, 2019 on the Nasdaq (“BYND”). Our Beyond Meat exit yielded a 29.32x multiple after accounting for all fees and expenses.

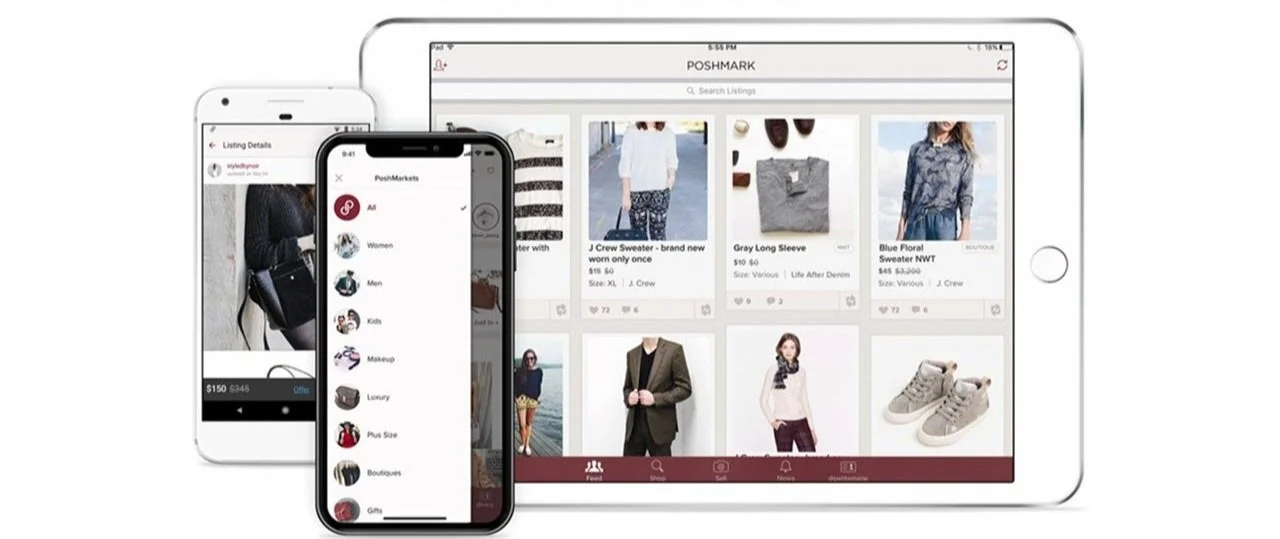

Poshmark

-

Direct Co-Investment with (INSERT VC FIRM)

-

Beyond Meat is an alternative meat source…..

-

why we invested? due diligence? how did we know it was a winner?

-

IPO? Net irr? etc

Our Funds

-

Year: 2012

Fund Size: $106.3M

Net IRR: 20.5%

-

Year: 2014

Size: $16.8

Net IRR: 46.5%

-

Year: 2014

Size: $86.8M

Net IRR: 22.5%

-

Aggregate

Year: 2016

Size: $64.1M

Net IRR: 16.9%

Stated Strategy

Year: 2016

Size: $14.1M

Net IRR: 23.1%

-B

Year: 2016

Size: $100M

Net IRR: 29.6%

-

Year: 2021

Size: $59M

Net IRR: NM